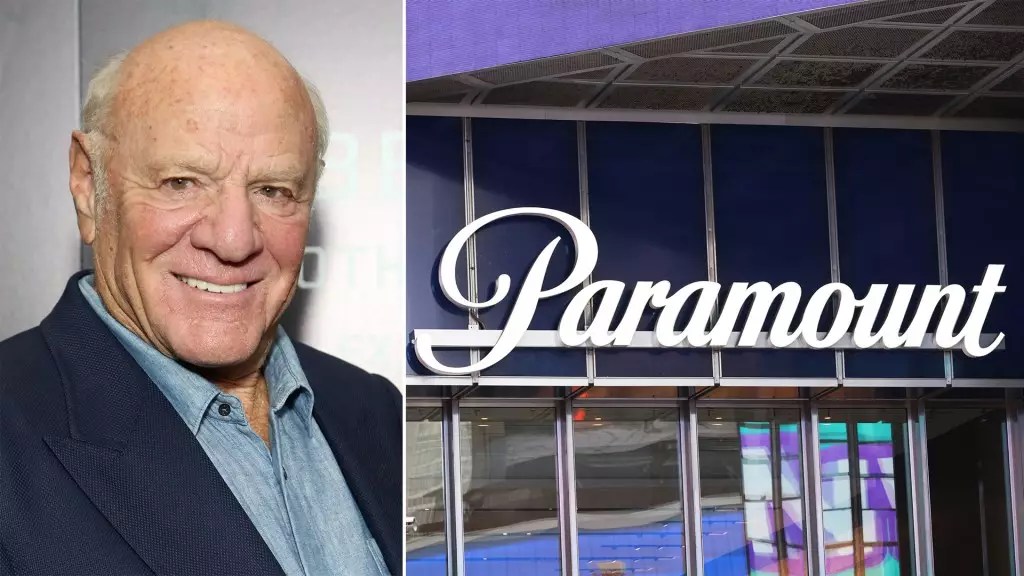

Barry Diller, a media mogul with an extensive background in the entertainment industry, is reportedly considering a bid for Paramount. The New York Times has reported that Diller’s IAC Corp. has entered into nondisclosure agreements with National Amusements Inc., the controlling stakeholder of Paramount. Diller, who previously served as the head of Paramount Pictures, is now looking to take control of the company in what could be a significant acquisition.

The potential acquisition by Barry Diller is just the latest development in Paramount’s ongoing sale saga. The company has seen interest from various parties, including Sony, Edgar Bronfman Jr., and an investor group led by Steven Paul. Despite talks with multiple suitors, it was only Skydance and Apollo Global Management that had discussed a full takeover of Paramount. Most potential buyers have looked at acquiring majority control through National Amusements, rather than a complete acquisition of the company.

Paramount has been facing numerous challenges recently, including falling stock prices and executive shake-ups. Following the ousting of CEO Bob Bakish in April, three executives were installed to replace him in an unconventional Office of the CEO setup. The company’s stock prices have reached record lows since the 2019 Viacom-CBS merger, further complicating its position in the market. Despite these challenges, Diller’s interest in acquiring Paramount has sparked some positive movement in the stock prices.

In an effort to navigate through these uncertain times, the new co-CEOs of Paramount Global, George Cheeks, Chris McCarthy, and Brian Robbins, have taken charge. They have already hired bankers to explore opportunities to sell off assets in an attempt to streamline the business. At a recent company town hall, the executive trio expressed confidence in their strategic plan, assuring employees that they are working towards setting the stage for growth at Paramount.

Despite his long-standing ties to the entertainment industry, Barry Diller has been more focused on his digital ventures, such as InterActive Corp., in recent years. His potential bid for Paramount marks a return to his roots in the film industry and could signal a new chapter in the company’s history.

Barry Diller’s exploration of a bid for Paramount comes at a critical time for the company. With ongoing sale discussions, executive changes, and market challenges, the potential acquisition could have significant implications for the future of Paramount. It remains to be seen how this story will unfold in the coming weeks and months.

Leave a Reply